A SEPA Credit Transfer (SCT) is a payment instrument which facilitates the transfer of funds from the sending or originating bank to the receiving or beneficiary bank.

They generally used for once off payments and clear within a day. To send/receive a SEPA Credit Transfer, the originating and beneficiary banks must be SEPA participants.

Debtors and creditors use SCT Transfers conducted in Euro currency, which include IBANs and BICs for identification.

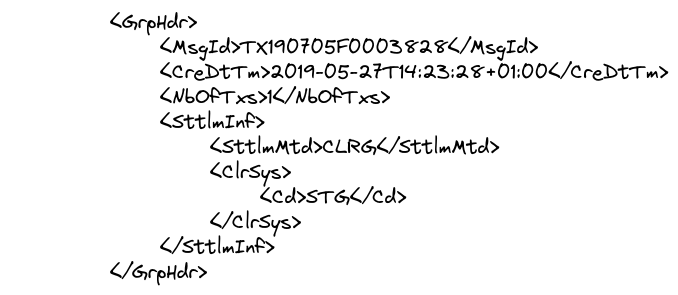

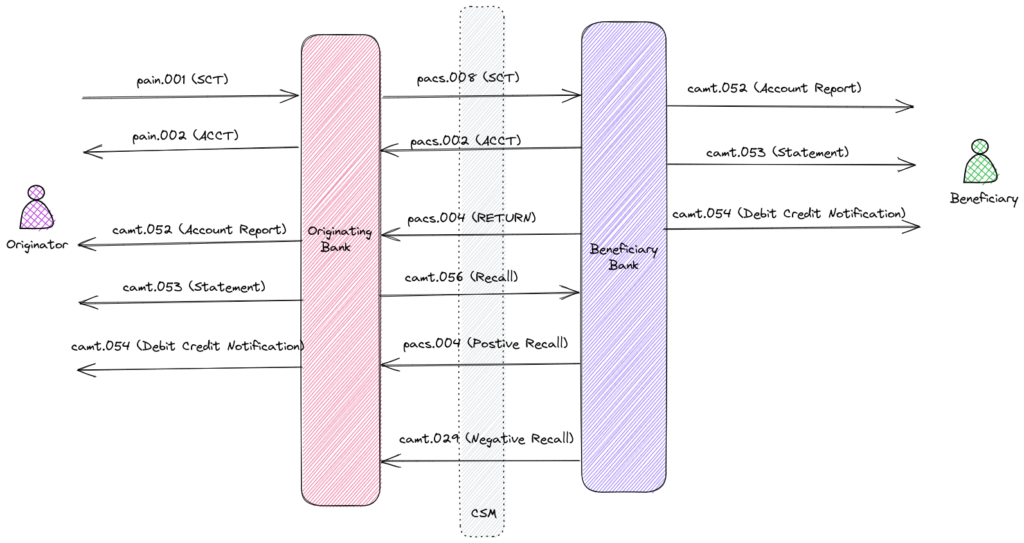

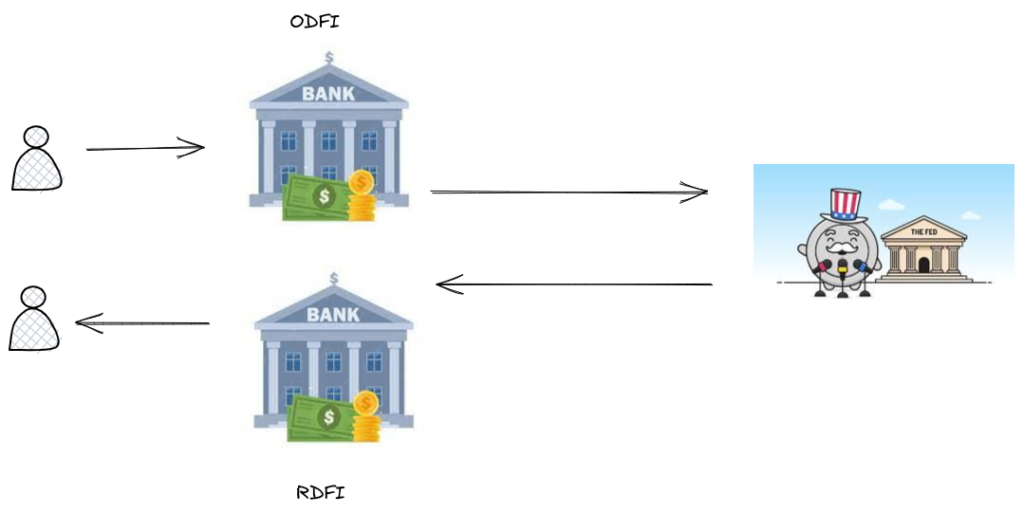

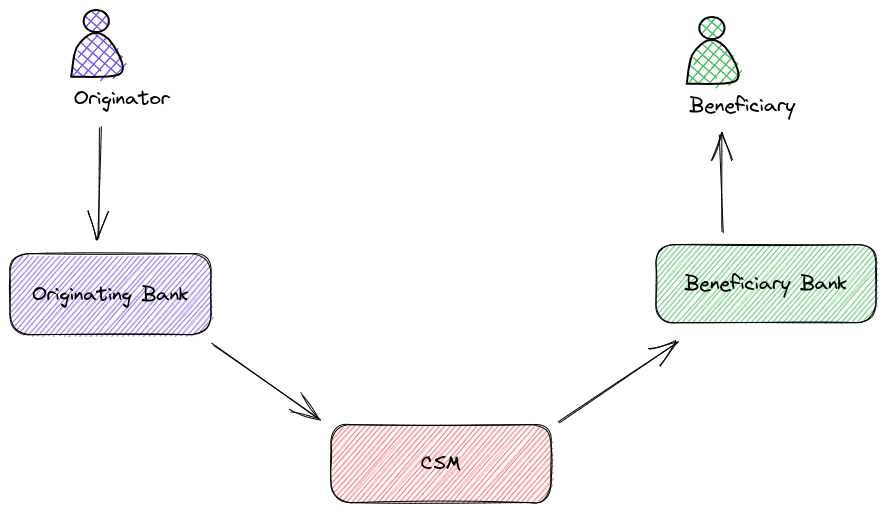

A SEPA Credit Transfer(SCT) involves the exchange of a number of messages between a debtor, their bank, the clearing and settlement (CSM) exchange and the beneficiary bank.

The SCT relies on 4 actors:

- Originator, i.e the person making the payment

- Originating bank, i.e the bank which contains the account of the originator

- Beneficiary, i.e. the person receiving the payment

- Beneficiary bank, i.e the bank which contains the account of the beneficiary

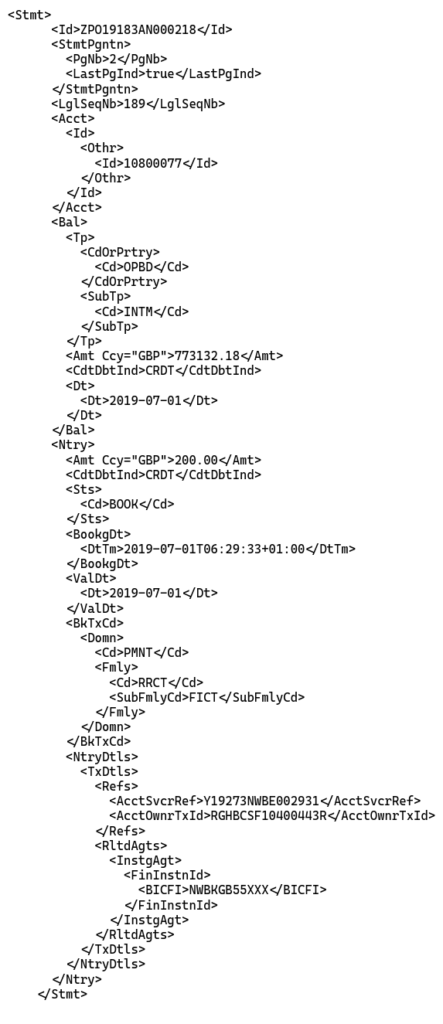

The originator and beneficiary use different ISO 20022 messages to initiate and complete the credit transfer. These messages are categorised as follows:

- Payment Initiation (Pain). Sent/received between the customer and their respective banks.

- Payment Clearing and Settlement (Pacs). Sent/received between the originating/beneficiary banks and the CSM.

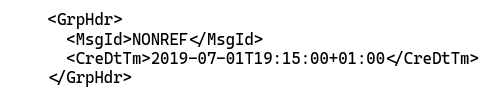

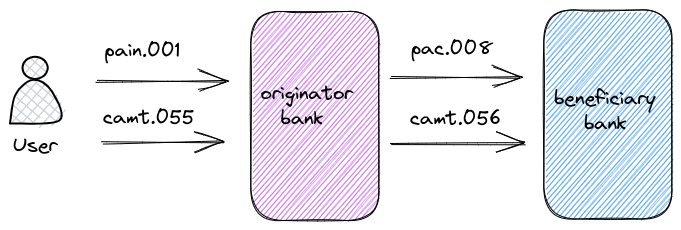

- Cash Management (Camt). Sent to the originator/beneficiary to inform them of their account balances as a result of payment transaction.