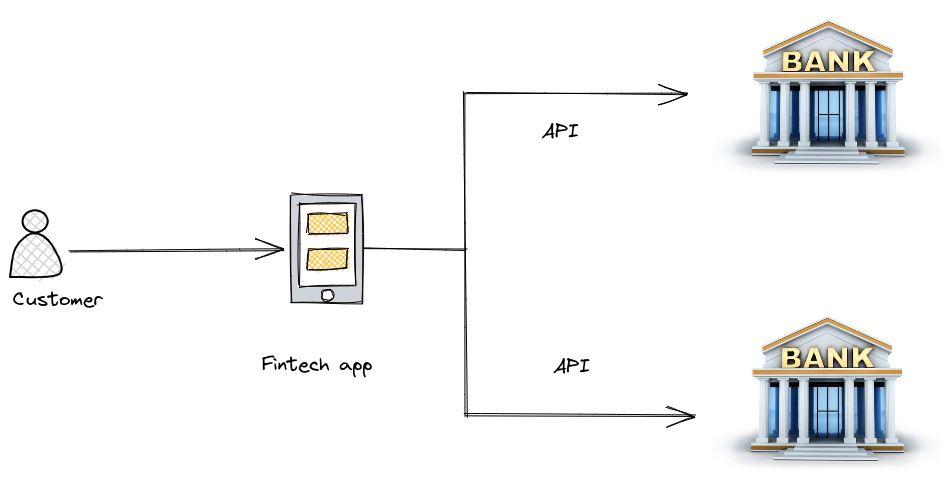

Open Banking allows banks and registered third party vendors access consumers financial data as long as they have the consumers explicit consent. By doing so, it allows non-banks offer banking functionality.

A customer authorises apps to access their bank data. Those apps are run by third party organisations known as TPPs. These apps must have the consent of customers before they can access a customer’s data and they must do it in a secure and standardised manner. Customer’s data is accessed via secure Application Programming Interfaces (APIs).

Examples of third party vendor who may wish to access your financial data could be budgeting or cash flow management apps.

Why do we need Open Banking?

Banks hold the most valuable data a person has, i.e. where and how they spend their money. Banks know how much we spend, where we spend it and on what.

Open Banking makes it easier for registered third parties access this data and provide services on this data.

What are the benefits of Open Banking?

- Better understanding and management of your finances. Lets you see all of your financial information in one location.

- By accessing a customers financial data, TPP apps could recommend better products and services as they become available.

- Lets customers pay online instantly. Most customers pay online with debit or credit cards which can fail and take a number of days to clear. Open Banking allows payments to be made instantly.

- Funds can moved instantly to apps used for things such as investing or betting.

What is PSD2?

Payment Services Directive, PSD2 is EU law which compels banks to allow registered third parties access consumer accounts. This facilitates innovation.

PSD2 also seeks to protect consumers by mandating stronger security through multi-factor authentication for user login.

PSD2 is integral to the growth of Open Banking within the EU as it mandates banks to make their customers financial data available via APIs to registered third party vendors. You can read more about PSD2 here