The ACH (automated clearing house) network is a payments network in the United States used to process low-value domestic payments. Two different operators run the ACH network:

- Electronic Payment Network (EPN). Run by the Clearing House.

- FedACH. Run by the Federal Reserve Banks.

The National Automated Clearing House Association (Nacha) govern the ACH network.

Approximately 11,000 financial institution use the ACH network in the United States.

What is an ACH Transfer?

An ACH transfer sends electronic funds over the ACH network. There are two types of ACH transfers:

- ACH Debits – Initiated by a payer to send funds directly to a receiving account. e.g. employee salaries

- ACH Credits – Initiated by a recipient to request funds, e.g. bills.

ACH transfers are batched, cheap and can be reversed.

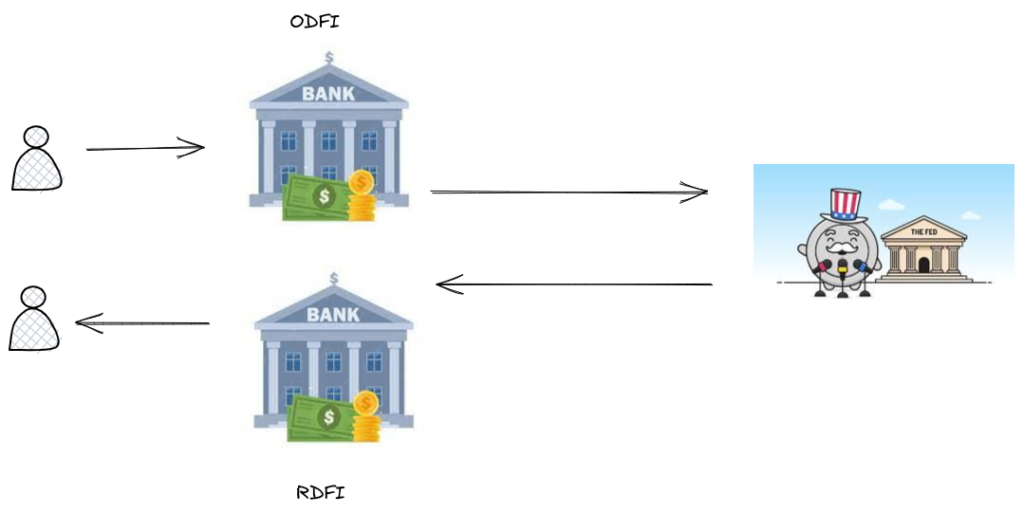

How does ACH work?

The ACH operators will batch these transfers according to the Receiving Depository Financial Institutions (RDFI) receiving the transfers. The RDFI receives these transfers at a number of set intervals during the day. An RDFI will debit/credit accounts based on the account and routing numbers.

An ACH transfer can complete in a number of hours or up to two business days depending on the time of the day or whether same day processing has been specified.

Examples of ACH Payments

- Direct deposit from employer to employees

- Household utility payments

- Business paying suppliers for products/services

- Funds transfer from one bank account to another