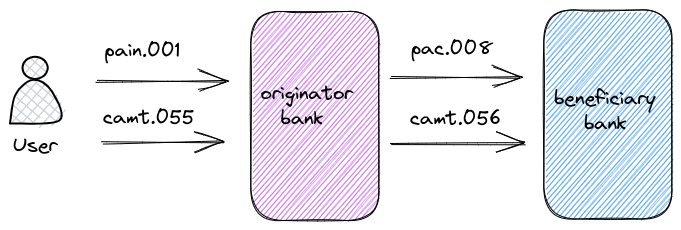

The camt.029 message is the response the beneficiary bank sends to the originator bank when it rejects the camt.056 that the originator bank sent.

The camt.056 is a recall message used to cancel a credit transfer. It is the response to that camt.056 indicating that the camt.056 request was unsuccessful.

The camt.029 is a notification message. It is also known as a resolution of investigation and indicates to the originator that there will be no movement of funds to the originator.

The camt.029 is the opposite of the pacs.004 (positive response). The definition of the camt.029 and its message definition report can be found here.

Building Blocks of Camt.029

Camt.029 is composed of two blocks:

CaseAssignment

Identifies the party that initiated the investigation. It will also identify the party who the investigation refers to. It will contain the following elements:

- Case Identification: A unique identifier assigned to the case

- Creation Date and Time: The date and time when the case assignment was created.

- Initiating Party: Information about the party initiating the case

- Case Assignee: Information about the party to whom the case is assigned

- Case Type: Indicates the type or category of the case (e.g., fraud investigation, customer complaint, transaction discrepancy).

- Case Priority: Specifies the priority level assigned to the case

- Case Subject: Provides a brief description of the case subject.

- Case Description: Offers a more detailed description of the case.

- Related Parties: Information about any parties involved with the case, such as the affected customer or counterparty.

- Case Status: Indicates the current status of the case (e.g., opened, in progress, resolved)

<Assgnmt>

<Id>NegativeResponsetoaRecall</Id>

<Assgnr>

<Agt>

<FinInstnId>

<BIC>BTRLRO22</BIC>

</FinInstnId>

</Agt>

</Assgnr>

<Assgne>

<Agt>

<FinInstnId>

<BIC>INGBROBUXXX</BIC>

</FinInstnId>

</Agt>

</Assgne>

<CreDtTm>2019-11-28T12:27:39</CreDtTm>

</Assgnmt>UnderlyingTransaction

Specifies the details of the underlying transactions being cancelled. It contains the following elements:

- Case Identification: The unique identifier of the original case that is being cancelled or reversed.

- Cancellation Reason: An explanation for the cancellation or reversal of the case assignment.

- Cancellation Date and Time: The date and time when the cancellation of the case assignment took place.

- Initiating Party: Information about the party initiating the cancellation or reversal

<CxlDtls>

<TxInfAndSts>

<CxlStsId>NegativeResponsetoaRecall</CxlStsId>

<OrgnlGrpInf>

<OrgnlMsgId>ORIGINAL PACS.008</OrgnlMsgId>

<OrgnlMsgNmId>pacs.008.001.02</OrgnlMsgNmId>

</OrgnlGrpInf>

<OrgnlInstrId>SCTORD156820191128000000000023</OrgnlInstrId>

<OrgnlEndToEndId>NOTPROVIDED</OrgnlEndToEndId>

<OrgnlTxId>107</OrgnlTxId>

<TxCxlSts>RJCR</TxCxlSts>

<CxlStsRsnInf>

<Orgtr>

<Id>

<OrgId>

<BICOrBEI>BTRLRO22</BICOrBEI>

</OrgId>

</Id>

</Orgtr>

<Rsn>

<Cd>AGNT</Cd>

</Rsn>

</CxlStsRsnInf>

<OrgnlTxRef>

<IntrBkSttlmAmt Ccy="EUR">30</IntrBkSttlmAmt>

<IntrBkSttlmDt>2019-11-28</IntrBkSttlmDt>

<SttlmInf>

<SttlmMtd>CLRG</SttlmMtd>

<ClrSys>

<Prtry>ST2</Prtry>

</ClrSys>

</SttlmInf>

<PmtTpInf>

<SvcLvl>

<Cd>SEPA</Cd>

</SvcLvl>

</PmtTpInf>

<RmtInf>

<Ustrd>test</Ustrd>

</RmtInf>

<Dbtr>

<Nm>John Doe</Nm>

</Dbtr>

<DbtrAcct>

<Id>

<IBAN>RO83BTRLY3TSFANS83CS8NHG</IBAN>

</Id>

</DbtrAcct>

<DbtrAgt>

<FinInstnId>

<BIC>BTRLRO22</BIC>

</FinInstnId>

</DbtrAgt>

<CdtrAgt>

<FinInstnId>

<BIC>INGBROBUXXX</BIC>

</FinInstnId>

</CdtrAgt>

<Cdtr>

<Nm>Bruno</Nm>

</Cdtr>

<CdtrAcct>

<Id>

<IBAN>RO41INGBIJEHFMQA3Y4VY19V</IBAN>

</Id>

</CdtrAcct>

</OrgnlTxRef>

</TxInfAndSts>

</CxlDtls>