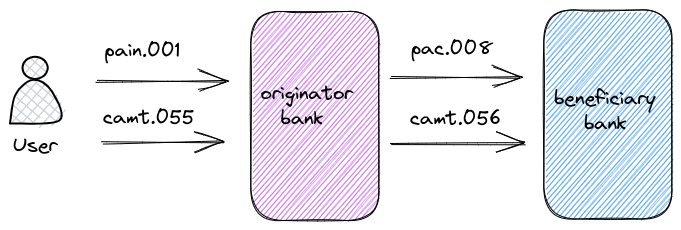

The originating bank sends the camt.056 message to the beneficiary bank to cancel a credit transfer.

You can find the definition of the camt.056 schema and its message definition report here

One of the most common reasons for issuing a camt.056 is a duplicate payment.

The camt.056 requires a response from the beneficiary bank within 15 working days.

This response can be:

- Positive response to the recall. In this case a pacs.004 is sent by the beneficiary to the originator and the money is credited to the originator

- Negative response to the recall. In this case a camt.029 is sent to the debtor bank. In this case stays with the beneficiary.

Building blocks of Camt.056

The Camt.056 will contain the following elements:

- Message Identification: A unique identifier assigned to the message.

- Related Reference: Reference to a related message or transaction.

- Payment Instruction Details: Details about the payment instruction being transmitted.

- Payment Transaction Information: Information about individual payment transactions, including amounts, dates, and parties involved.

- Settlement Details: Information related to the settlement of the payment, such as clearing and settlement system details.

- Remittance Information: Information about the remittance advice or additional payment details.

- Regulatory Reporting Information: Information required for regulatory reporting purposes.

- Additional Information: Any additional relevant information associated with the payment message.

- Supplementary Data: Optional additional data included with the message.