ISO 20022 is a common language and model for financial messages across the world.

It covers five financial areas:

- Payments

- Securities

- Trade services

- Cards

- FX (Foreign Exchanges).

More information can be found here

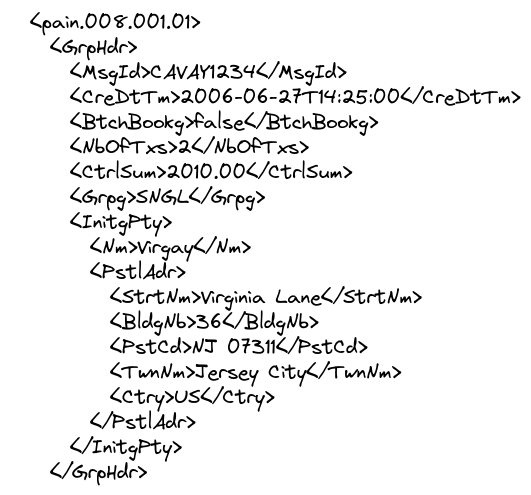

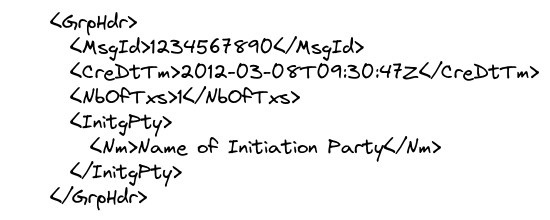

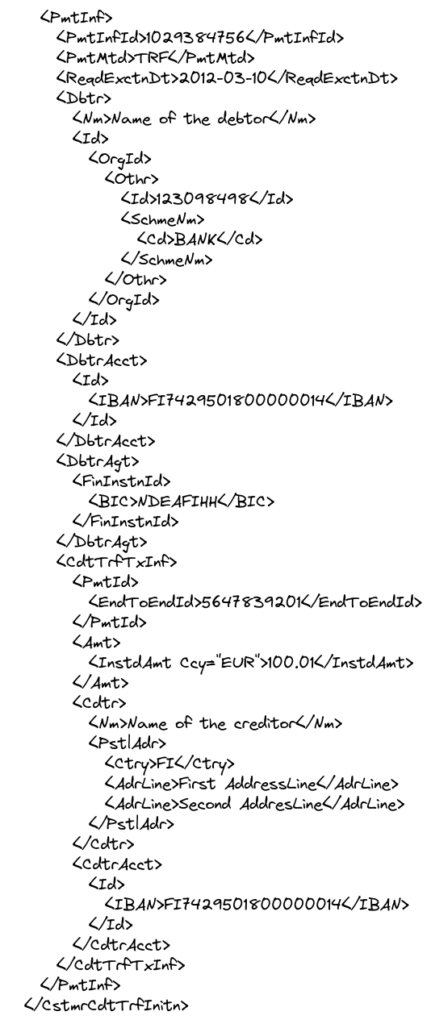

A key part of the SEPA is the use of the ISO 20022 messaging standard using XML during payment processing.

The ISO 20022 payments standard will apply to domestic, ACH, high value and cross-border payments and by 2025 it will be the universal standard for high value payment systems of all reserve currencies.

The standard breaks down to the following areas:

- Account Management (acmt)

- Cash Management (camt)

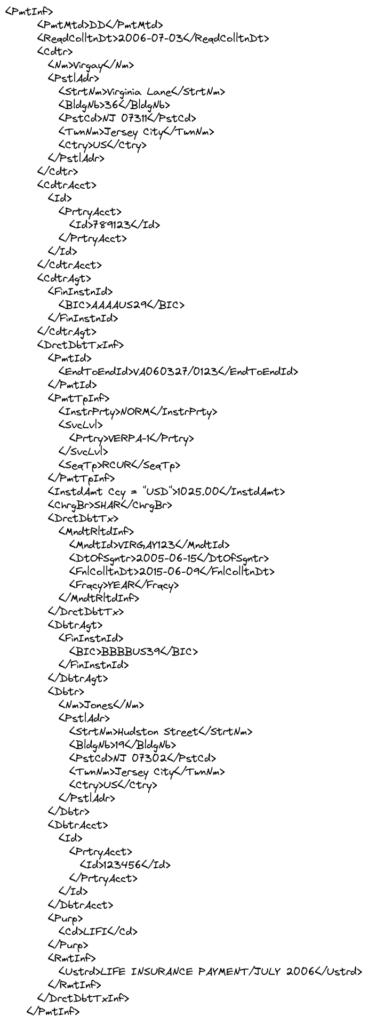

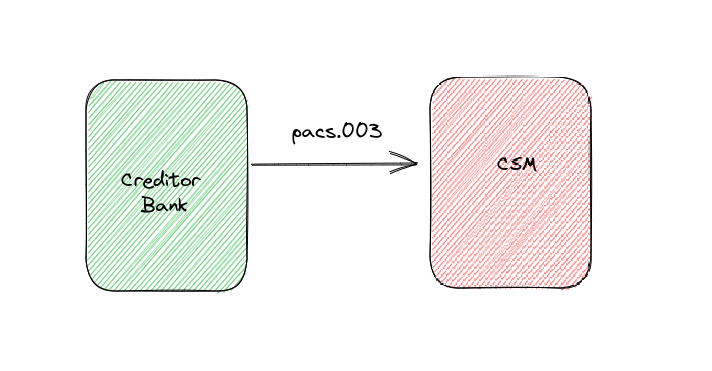

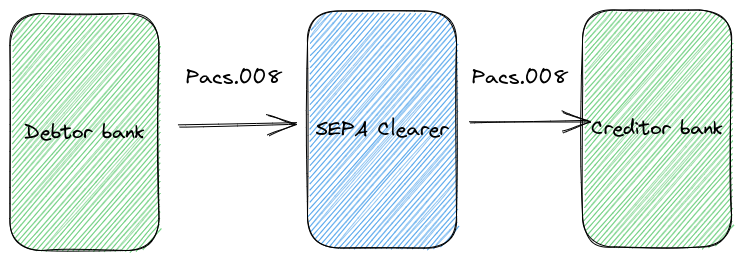

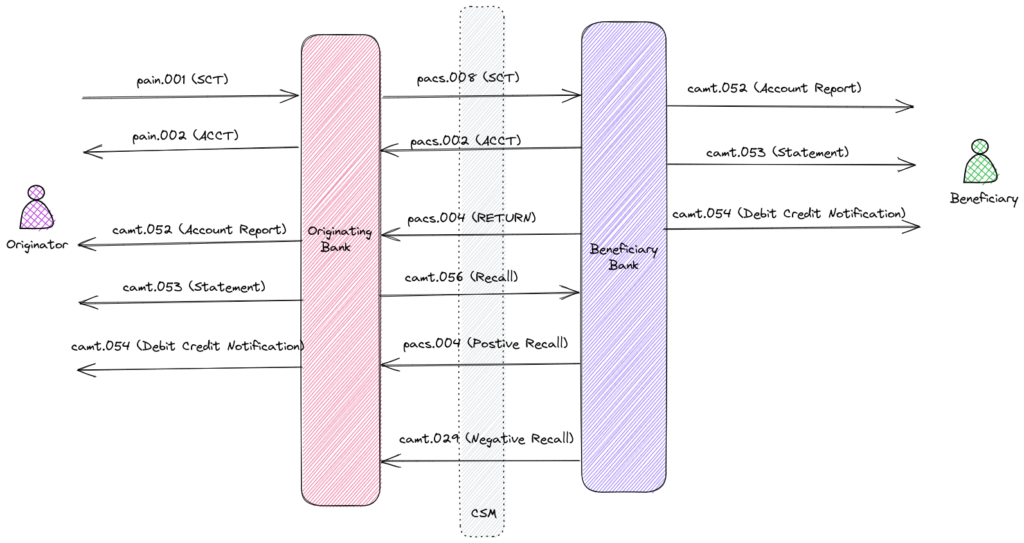

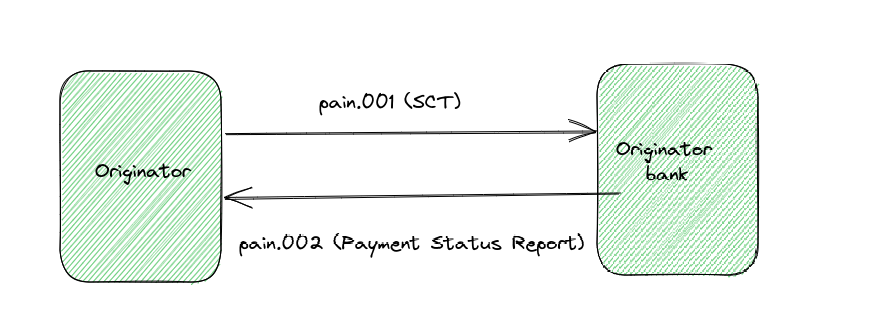

- Payments clearing and settlement (pacs)

- Payment initiation (pain)

Over 70 countries have adopted the standard including Japan, China, and India. Currently over 200 payment types are supported. This facilitates harmonisation between different payment methods and systems around the world.

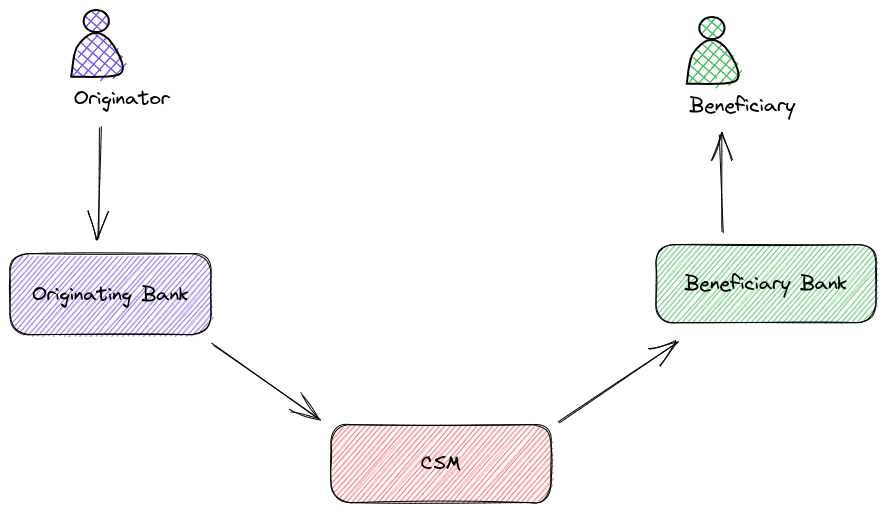

Messages are available within the standard for the complete end-to-end payments chain: customer to bank (payment), bank to bank (payment clearing and settlement) and reporting (cash management).

Advantages of ISO 20022

- Improved Straight through processing rates through the use of common language and format among payment systems.

- Facilitates better analytics. This leads to better AML more effective claims and investigations.

- More enriched data should lead to improved understanding of customer needs and new sources of revenue such as Request to Pay.

- Supports a much larger character set than that of MT messages. This is very important in countries such as China.

- Greater protection against Anti Money Laundering (AML) and other financial crimes.

What is its relationship to SEPA?

All banks operating within the Single Euro Payments Area must adhere to the SEPA payment standard which conforms to the ISO 20022 standard. All SEPA payment messages are compliant with ISO 20022. However SEPA payment messages will be more restrictive in applicable business rules than their ISO 20022 counterparts.

What is the difference between ISO 15022 and ISO 20022?

ISO 15022 is an ISO standard for securities messaging used in transactions between financial institutions across the SWIFT network. ISO 20022 will replace the ISO 15022 standard.