Overview

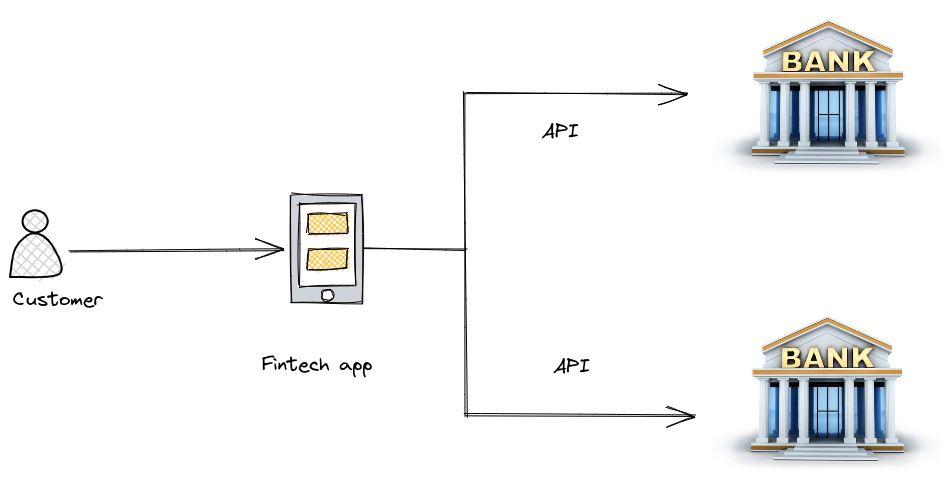

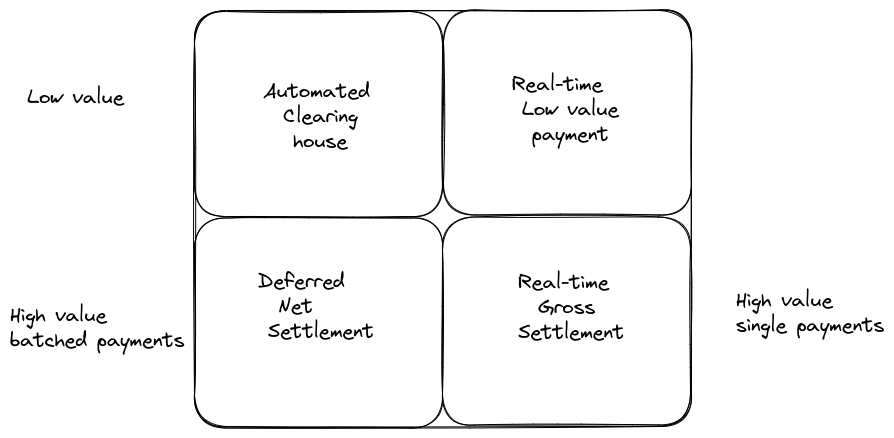

Banks generally separate their payment systems into high and low value streams:

- High value payments (inter-bank payments)

- Low value payments (retail payments).

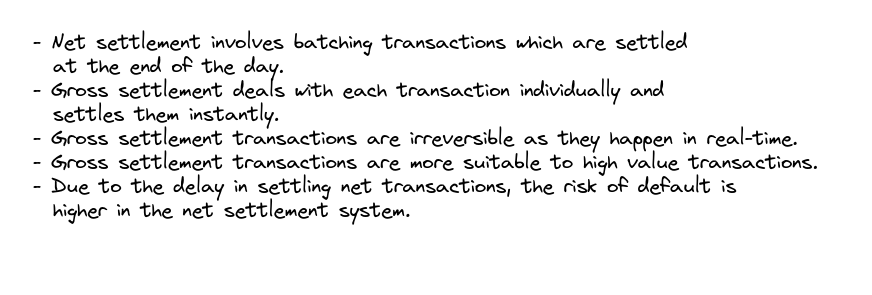

High value payments are settled instantly. Low value payments are batched and settled generally at end of day.

High Value Payment Systems (HVPS)

HVPS transfer large value inter-bank transactions. Transactions settle in real-time and instantly. HVPS are Real Time Gross Settlement Systems (RTGS).

Generally HVPS do not have an upper limit on the monetary value of transactions allowed. Central banks will have oversight of the HPVS in individual countries ensuring stability and reliability. They also will use robust security to guard against fraud, hacking and other malicious behavour.

Examples

Low Value Payment Systems (LVPS)

LVPS are deferred settlement systems. Payments are batched and settled at a certain point in the day. Transaction amounts are on average low in comparison to high value payments.

Low value payments constitute the vast majority of payments. Individually they pose no systemic risk and it is inefficient and expensive to process them in a real time basis. They settle in batches at the end of the day.

LVPS are also known Batch EFT (Electronic funds transfer) or ACH (Automated Clearing House) payment systems.

SWIFT supports over 25 low-value payment systems.

Examples

| CHIPS (United States) |

| NEFT (United States |

| BECS (Australia) |

| SEPA (EU) |