CHAPS is acronym for Clearing House Automated Payment System. It is a high-value payment systems, operated by the Bank of England, providing efficient, settlement risk-free and irrevocable payments in Sterling. It was first introduced in 1984.

CHAPS is an RTGS where settlement is risk-free, i.e. because each payment is settled individually, in real-time. It is primarily used for the same-day settlement of high-value wholesale payments as well as time-critical, high value retail payments like house purchases.

In 2019 it processed over 35 millions high value payments with a total monetary value on 75 trillion GBP.

Who uses CHAPS?

There are over 35 financial institutions, known as direct participants, who make payments over CHAPS. Direct participants include high street banks, financial market infrastructures and challenger banks.

Several thousand other banks make payments through direct participants (correspondent banking).

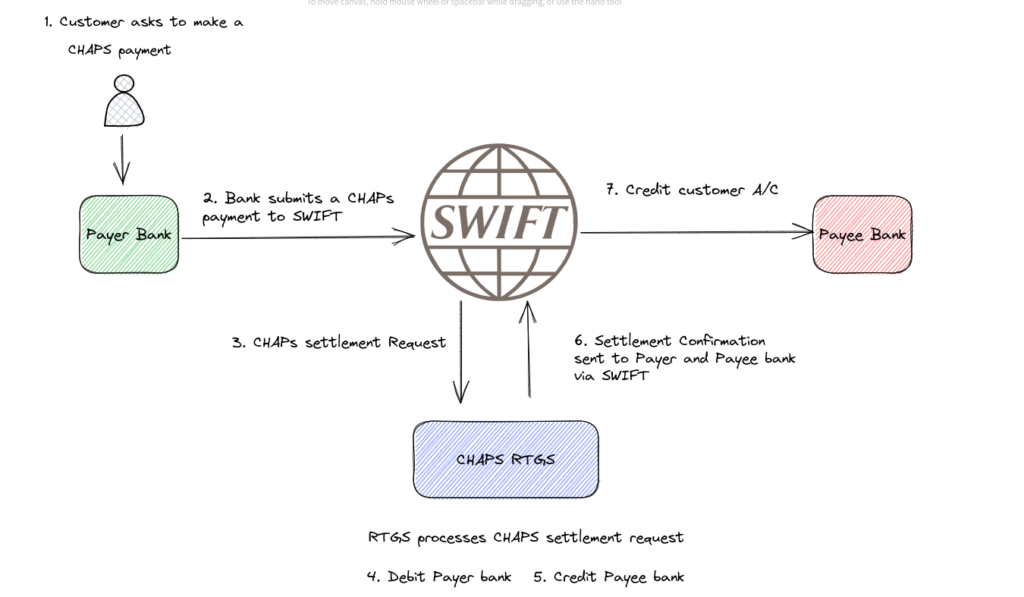

How does CHAPS work?

What are the benefits?

- Supports secure high value, same day payments from payment service providers to their customers.

- Payments are highly secure using the SWIFT payment infrastructure together with the Bank Of England’s RTGS system. There is no upper/lower payment limits.

- Among direct participants, the liquidity requirements eliminate settlement risk.

- The system processes and settles transactions on the same day, thus ensuring that the beneficiary receives payments on the same day as the payment initiation.

- Allows the direct transfers between direct participants and financial institutions eliminating the need for intermediaries.