The Clearing House (TCH) , www.theclearinghouse.org, are a US financial institution that clear and settle over $2 trillion dollars of ACH, wire, real-time payments and checks every day. It owns and operates the RTP platform.

TCH also operates one half of the ACH network, while the Federal Reserve operates the other half. It is owned by a collective of 24 large banks. These are both domestic US and international banks.

TCH runs a number of payments systems such as:

- CHIPS (Clearing House Interbank Payments System):

- RTP (Real-Time Payments)

- ACH (Automated Clearing House)

What is CHIPS?

CHIPS is an acronym for Clearing House Interbank Payments System and is the largest clearing system for wire transfers in US dollars. It settles approximately 1.8 trillion dollars daily.

CHIPS is not an RTGS and does not settle payments in real-time. It is a netting engine and aggregates payments over the course of the day.

What is RTP?

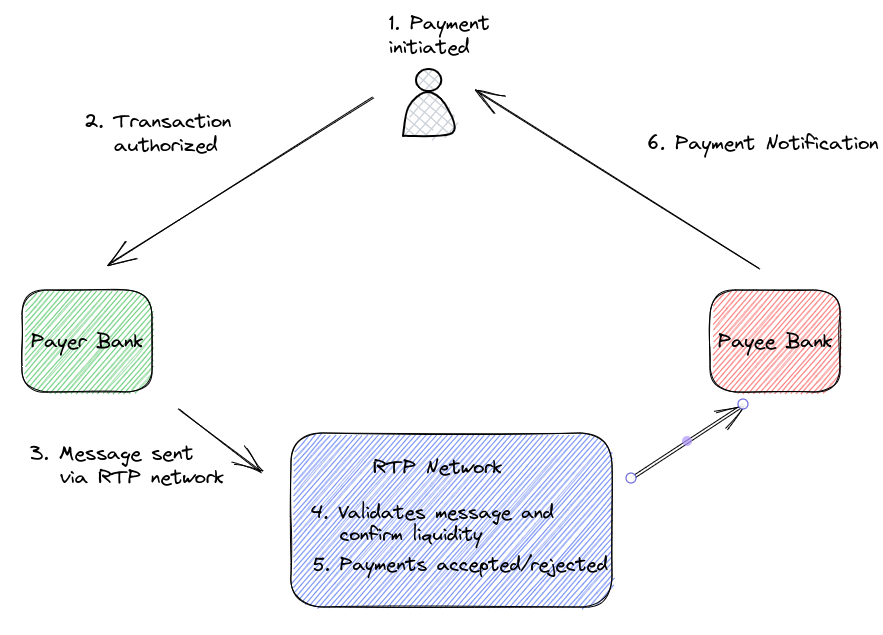

RTP is a real-time payments platform that allows banks insured by the US government to clear and settle payments in real time. An RTP payment resembles an instant wire transfer.

Real-time payments over the RTP network provide financial institutions with the capability to send payments directly from their accounts 24/7, and to receive and access funds sent to them over the RTP network immediately.